报告题目:Factor Models with Downside Risk

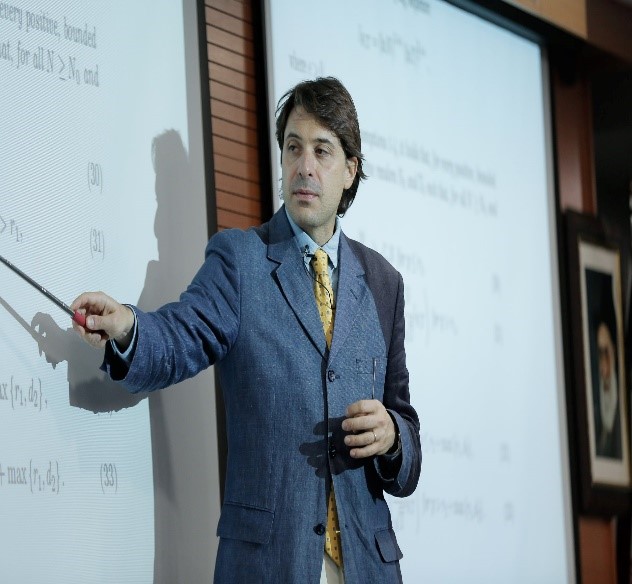

主 讲 人:LORENZO TRAPANI

报告时间:2021年4月1日16:30-17:30

报告地点:腾讯会议 会议 ID:102 802 779

点击链接入会:https://meeting.tencent.com/s/MCeJaTFyIQzq

报告摘要:We propose a conditional model of asset returns in the presence of common factors and downside risk. Specifically, we generalize existing latent factor models in three ways: we allow for downside risk via a threshold specification which allows for the estimation of the ‘disappointment’ event, which therefore does not need to be assumed arbitrarily; we permit different factor structures (and number of factors) in different regimes; we show how to recover the observable factors risk premia from the estimated latent ones in different regimes. The usefulness of this generalized model is illustrated through two applications to cross-sections of asset returns in equity markets and other major asset classes.

主讲人介绍: LORENZO TRAPANI is a professor of econometrics at School of Economics,

University of Nottingham. He also acts as the director of Sir Clive Granger Research Centre for Time Series Econometrics. His main research interest includes econometric theory, asymptotic theory, factor models, randomised tests and so on. He has published his work on TOP econometrics and statistics journals such as Journal of Econometrics, Journal of American Statistical Association, Econometric Theory.

邀请人:何勇

欢迎各位老师同学积极参加!